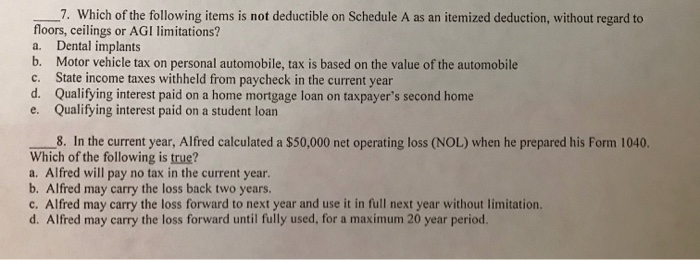

are dental implants tax deductible in the united states

Part of its innovative design is protected by intellectual property IP laws. The average cost for a dental implant without insurance is between 3000 and 4500 per tooth and may reach between 20000 and 45000 if you need a mouthful of implants according to the.

How To Pay For Full Mouth Dental Implants New Teeth Now

Even with health insurance dental work can still come at a significant cost.

. Finally if you qualify for. Visit wwwHealthCaregov to compare plans and see what your premium deductible and out-of-pocket costs would be before you make a decision to enroll. We are the ONLY patient advocacy organization fighting for the best science that will lead to a greater understanding of Temporomandibular and related disorders and treatments that will help and not harm patients.

6 Other Possible Grants. Costs are based on a 15- to 18-month treatment period that also helps to correctly align the jaw. This program gives you access to a worldwide network of dentists and dental clinics.

Some older adults eligible for Medicaid insurance might find they have coverage for medical alert systems. 82 Can I choose any dentists in order to give me an assessment. With over 100000 in-network.

Free dental implants include the expensive procedure of teeth implantation for free or at low cost. Some have estimated that 750000 American medical tourists traveled from the United States to other countries in 2007 up from 500000 in 2006. Microsoft has responded to a list of concerns regarding its ongoing 68bn attempt to buy Activision Blizzard as raised by the UKs Competition and Markets Authority CMA and come up with an.

In other words it reduces budget gap through tax. Sections 1814a and 1835a of the Act require that a physician certify or recertify a patients need for home health services but in general prohibit a physician from certifying or recertifying the need for services if the services will be furnished by an HHA in which the physician has a significant ownership interest or with which the physician has a significant. Your contribution is more than a donation.

Medicaid in the United States is a federal and state program that helps with healthcare costs for some people with limited income and resources. Following a bumpy launch week that saw frequent server trouble and bloated player queues Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 daysSinc. Saving tax free for medical and dental expenses is a good reason to start an HSA.

Make a tax-deductible contribution today. Tax equity and fiscal responsibility act of 1982 tefra TEFRA was a United States federal law that rescinded some of the effects of the Kemp-Roth Act passed the year before 1982 as result of ongoing recession fall in tax revenue generated over the budget deficit. 81 Could I use this grant toward general dental care.

That means the impact could spread far beyond the agencys payday lending rule. Spirit Dental is a broker for Ameritas dental plan and is backed by Ameritas Life Insurance company. A MESSAGE FROM QUALCOMM Every great tech product that you rely on each day from the smartphone in your pocket to your music streaming service and navigational system in the car shares one important thing.

Getting the best orthodontic insurance is part research and part. The largest dental insurer of all ages in the United States sells individual and group dental plans including an AARP-branded plan. Medicaid also offers benefits not normally covered by Medicare including nursing home care and personal care servicesThe main difference between the two programs is that Medicaid covers healthcare costs for people with.

Vehicle insurance also known as car insurance motor insurance or auto insurance is insurance for cars trucks motorcycles and other road vehiclesIts primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Medicaid is a federal program administered by individual states and eligibility depends. If you are a Service Benefit Plan member and have enrolled in the Blue Cross Blue Shield BCBS FEP Dental Program and have visited the dentist the dental provider sends the claim to the local Plan or other carrier listed on your medical ID.

The thinking from insurance companies in the US. You can now receive expert dental care when you are outside of the United States through our Passport Dental program. 3 Government Grants For Dental Implants.

A report of McKinsey and Co. We cannot change the face of TMJ without YOU. United Healthcare dental insurance provides affordable dental coverage.

Microsoft pleaded for its deal on the day of the Phase 2 decision last month but now the gloves are well and truly off. Note That The Donation you make Comes under Tax Deduction Schemes Under IRSthe tax deduction rule for donating a car to charity is applicable in all 50 states not every state has programs offering free cars to single moms. 7 Other Possible Ways To Pay Dental Implants.

It is how we will. Dental implants full or mini are considered cosmetic. Vehicle insurance in the United States also known as car insurance or auto insurance is designed to cover the risk of financial liability or the loss of a motor vehicle that the owner may face if their vehicle is involved in a collision that results in property or physical damageMost states require a motor vehicle owner to carry some minimum level of liability insurance.

From 2008 found that between 60000 and 85000 medical tourists were traveling worldwide for the purpose of receiving in-patient medical care. Having Delta Dental coverage makes it easy for you to get dental care almost everywhere in the world. If your provider routinely waives your cost.

To qualify to make HSA contributions in 2022 you must have an HSA-eligible health insurance policy with a deductible of at. You could be eligible for a new kind of tax credit that lowers your monthly premiums. The holding will call into question many other regulations that protect consumers with respect to credit cards bank accounts mortgage loans debt collection credit reports and identity theft tweeted Chris Peterson a former enforcement attorney at the CFPB who is now a law.

Plans for seniors range from 36 to 74 per month and the maximum annual benefits range from 1200 to 5000. Microsoft describes the CMAs concerns as misplaced and says that. 100 lifetime deductible.

Card for processing and issuing an Explanation of Benefits EOB. Is a nonprofit that gives away donated cars all through the United States including Alaska and Hawaii. Coverage for children through age 18 at 50 and only a 150 lifetime deductible for orthodontics 1000 lifetime maximum benefit.

At the same time the claim along with any balance will be forwarded to Blue. According to the McKinsey and Co Report. Is that unless it solves a necessary issue its cosmetic.

If you get dental implants you can expect to spend 3000 to 5000 per tooth. The average cost of braces is between 5000 and 6000 and many dental insurance plans dont provide coverage for orthodontics.

What Are The Different Medical Deductions With Pictures

Let Uncle Sam Help With Payments Crown Point Dentistry Financing Advanced Dental Concepts

Solved 7 Which Of The Following Items Is Not Deductible On Chegg Com

![]()

Blog Archives Page 2 Of 3 G4 By Golpa

12 Easy Ways To Get Affordable Dental Implants In 2022 Authority Dental

Cheap Dental Implants Step By Step Guide Updated For 2022

How To Get Insurance To Pay For Dental Implants

The Complete Guide To Getting Dental Implants In Thailand

Dental Implant Cost Near Me Clear Choice Cost Maryland

What Dental Work Is Tax Deductible

A Tax Deduction For Invisalign The Studio For Exceptional Dentistry

Cost Of Ceramic Dental Implants

Covering Your Dental Implants With An Hsa Grandview Dental Care

Are Dental Implants Tax Deductible Atlanta Dental Implants

Are Dental Implants Tax Deductible Atlanta Dental Implants

Maxillary Anterior Aesthetic Reconstruction On Natural Teeth And Dental Implants A Case Report Henry Schein Dental

Is Cosmetic Dentistry Tax Deductible American Cosmetic Dentistry